Make your property safer, greener and more efficient with an PACE Loan from SELF -- now available in St. Lucie County, FL!

St. Lucie County PACE Financing is a SELF Loan Program alternative financing solution to overcome the upfront costs of implementing energy-saving, renewable energy, and resilience projects in St. Lucie County, FL.

Based on the Property Assessed Clean Energy (PACE) model, financing is secured by an assessment lien and is repaid as a line item on the property tax bill. This allows property owners to invest in longer-term, clean energy improvements that can generate positive cash flow and environmental benefits.

Eligible Properties in St. Lucie County

New Construction Benefits:

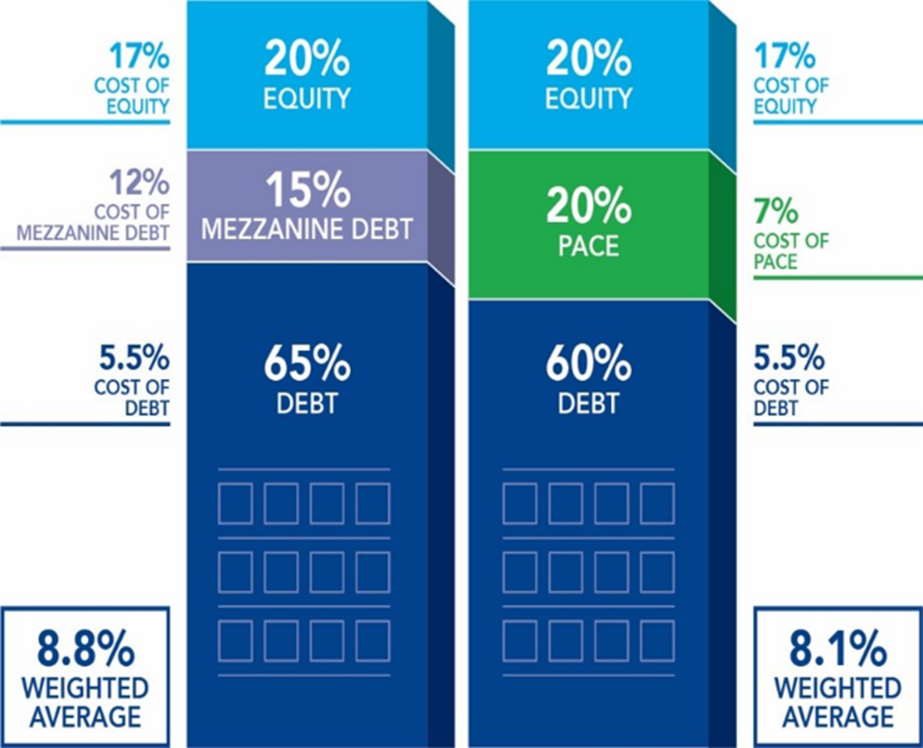

Commonly used to finance projects in existing buildings, property owners and developers are increasingly incorporating St. Lucie County PACE financing into the capital stack for new construction and major renovations

- St. Lucie County PACE Financing replaces equity and mezzanine debt with non-recourse, long-term financing (up to 20 years), with fixed-interest rates at a fraction of the cost.

- Up to 100% financing of eligible project costs, conserves working capital, and preserves owner’s equity for other purposes.

- Improves your collateral, reduces operating costs, increases property values, and achieves clean energy & sustainability goals.

- Creates a business case for completing clean energy improvements that improve occupant experience and extend a building’s lifespan.

- Assessments stay with the property upon sale and allow owners to share costs & benefits with tenants.

Loan Products & Rates*

$50,000

Origination and Project Management Fees for Residential projects are 4.5% for SELF + 3% for County.

Eligibility

- Subject Property must be located in St. Lucie County.

- Applicant(s) must prove ABILITY TO PAY (i.e., Employment, Social Security, Disability, etc.)**

- Net Equity in subject property

- Property Taxes must be current (last 3 years)

- Home Mortgage loans must be current (with proof)

- Primary Applicant cannot have a bankruptcy (past 3 years)

- Can be used for new construction.

- Not available to public buildings or facilities.

- Available for all land use types (e.g., Residential, Commercial, Agriculture, and Industrial)

**SELF and St. Lucie County upgraded Consumer Protections Standards for the local Energize SLC program beyond state law (F.S. 163.08) by requiring residential applicants to prove their Ability to Pay.

Eligible improvements include Clean Energy (e.g., solar PV), Energy Efficiency (e.g., A/C), and Wind Hazard Mitigation (e.g. Roofs, Windows).

Project Management: From Start to Finish

(Program Manager)

SELF also provides project management from start to finish, including: pre-screening all contractors to verify applicable licenses, insurance and a good track record; reviewing quotes to prevent price-gouging; and, coordinating with local building officials and homeowners before making final payment to the contractors.

Frequently Asked Questions

What is St. Lucie County PACE Financing?

St. Lucie County’s Property-Assessed Clean Energy program is a local government sponsored alternative financing program to make renewable energy and wind resistance improvements to qualifying properties.

St. Lucie County PACE Financing is a voluntary land secured assessment and is paid back over time on the property tax bill.

Financing is secured by equity in the subject property and remains with the property and not the owner.

St. Lucie County PACE Financing is not a personal or business loan and no credit check is required for the program.

In 2014, SELF created and began administering the only non-profit Property Assessed Clean Energy program in Florida for St. Lucie County.

What are the eligibility requirements?

Property owners must have equity in the subject property and be current on property taxes over the previous three (3) years.

Is the Energize SLC program free?

No. Funding from the St. Lucie County PACE Financing is not free. To participate, you must meet all Eligibility Requirements and have the Ability to Pay all applicable fees, principal, and interest. Energize SLC assessments are paid through annual installments as an additional non-ad valorem line item on your property tax bill. When the assessment is paid in full, the lien and line item will be removed.

Do I pay interest for the financing?

Yes. The St. Lucie County PACE Financing Program provides 100% upfront financing and charges interest over the selected repayment term. Interest rates are adjusted quarterly by Inland Green Capital LLC, in accordance with the Financing Agreement with St. Lucie County and federal Treasury bill rates.

Are there any other costs?

Yes. The St. Lucie County PACE Financing program charges up-front fees based on a percentage of total project costs and administration fees based on a percentage of annual payments. Applicants may pay upfront fees at the time of approval or roll these fees into the principal, which is payable each year with interest during the repayment term. Please note the local government administrative fees are charged annually as a part of the tax collection process.

Please closely review the Financing Estimate and all applicable fees for your St. Lucie County PACE Financing assessment before making a final decision.

How do I repay the St. Lucie County PACE Financing funds?

Repayment of St. Lucie County PACE Financing funds occurs through a voluntary assessment on your property tax bill. If you have a mortgage, your lender may include the property taxes and assessment in your monthly escrow payment. If so, your monthly mortgage payment will increase accordingly. Note that your mortgage lender will typically not make the adjustment until they receive the first tax bill with the St. Lucie County PACE Financing assessment. Please contact your lender for immediate adjustments.

What happens if I have trouble making the increased tax payment?

Do not proceed with an St. Lucie County PACE Financing assessment unless you have the ability to pay the principal, interest, and fees. If you default on your St. Lucie County PACE Financing obligations, by failing to pay your property taxes, a tax certificate will be sold on the subject property. After two years of unpaid tax certificates, your property could be sold through the Tax Deed Application process.

Can I refinance my home while I still am making payments to the St. Lucie County PACE Financing Program?

Energize SLC liens may impede your ability to refinance your mortgage loan or to receive a mortgage loan modification. Some lenders will not enter into new loan terms while an St. Lucie County PACE Financing program lien is assessed against the subject property. You may be required to prepay the St. Lucie County PACE Financing assessment as a requirement to refinancing, and prepayment fees will be charged on the outstanding balance of the St. Lucie County PACE Financing assessment.

Can I sell my home before I have paid off the St. Lucie County PACE Financing Program lien?

The St. Lucie County PACE Financing program lien is automatically transferred to the buyer when you sell the home; however, Fannie Mae, Freddie Mac, the Federal Housing Administration, and the Department of Veterans Affairs may not insure mortgages with Energize SLC assessments. Lenders are not required to accept St. Lucie County PACE Financing program liens. As a result, you may be required to prepay the St. Lucie County PACE Financing assessment as a requirement to selling the subject property, and prepayment fees will be charged on the outstanding balance of the St. Lucie County PACE Financing assessment.

What documents do I need to apply?

- Completed Application with Signature(s)

- Promise to Pay – Energize SLC Application & Title Search Fee Form

- Copy of Photo Identification of all signers

- Proof of Income supported by one or more of the following documents: Most current 2 months’ pay-stubs and/or W2 forms, Social Security and/or Disability Statement(s), Retirement statement(s), Rental Agreement for rental income.

- Self-Employed/Commission Borrowers must provide most current 2 years of tax returns (1040 forms and 1120’s when applicable) or 6 months of bank statements. (Include all pages and schedules & Profit and Loss statements.

- Copy of 3 Current Mortgage Statements (Most Recent 90 days)

- 30 Day Lender Notification Letter

Who do I contact if I have questions?

For any questions you may have regarding the status of your application, contact Chuck Washington or the St. Lucie County PACE Financing Manager.